Earned Income Limit For 2025

Earned Income Limit For 2025. The average amount of eitc received nationwide was about $2,541 1. The income limit for workers who are under the full retirement age will increase to $22,320 annually, with income above the limit having $1 deducted from benefits for every $2.

The average amount of eitc received nationwide was about $2,541 1. Income limits and amount of eitc for additional tax years.

Earned 2025 Dayle Erminie, Income limits and amount of eitc for additional tax years. In other words, if your income exceeds the cap on yearly earnings — which in 2025 is $22,320 for people who claim benefits before full retirement age — social.

Louisiana Earned Credit Worksheet 2019 Worksheet Resume Examples, Amounts for 2025 the monthly sga amount for statutorily blind individuals for 2025 is $2590. In 2025, you can earn up to $22,320 without having your social security benefits withheld.

Weekend reading “Discussing distributional tables” edition Equitable, Use the eitc tables to look up. For the 2025 tax year (taxes filed in 2025), the earned income credit will range from $632 to $7,830, depending on your filing.

Annual Earnings Limit For 2025 Abbey, Amounts for 2025 the monthly sga amount for statutorily blind individuals for 2025 is $2590. Earned income base amount required to get maximum credit:

2025 Tax Brackets The Best To Live A Great Life, Generally, the more countable income you have, the less your ssi benefit will be. Eitc is for workers whose income does not exceed the following limits in 2025:

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Earned Tax Credit (EITC) eligibility and benefits Stealth, The income limit for workers who are under the full retirement age will increase to $22,320 annually, with income above the limit having $1 deducted from benefits for every $2. In 2025, you can earn up to $22,320 without having your social security benefits withheld.

Earned Credit The Only Things You Need to Know, Amounts for 2025 the monthly sga amount for statutorily blind individuals for 2025 is $2590. The ira contribution limits for 2025 are $6,500 for those under age 50 and $7,500 for those 50 and older.

2025 Earned Tax Credit Free Cash Advance!, The income limit for workers who are under the full retirement age will increase to $22,320 annually, with income above the limit having $1 deducted from benefits for every $2. Amounts for 2025 the monthly sga amount for statutorily blind individuals for 2025 is $2590.

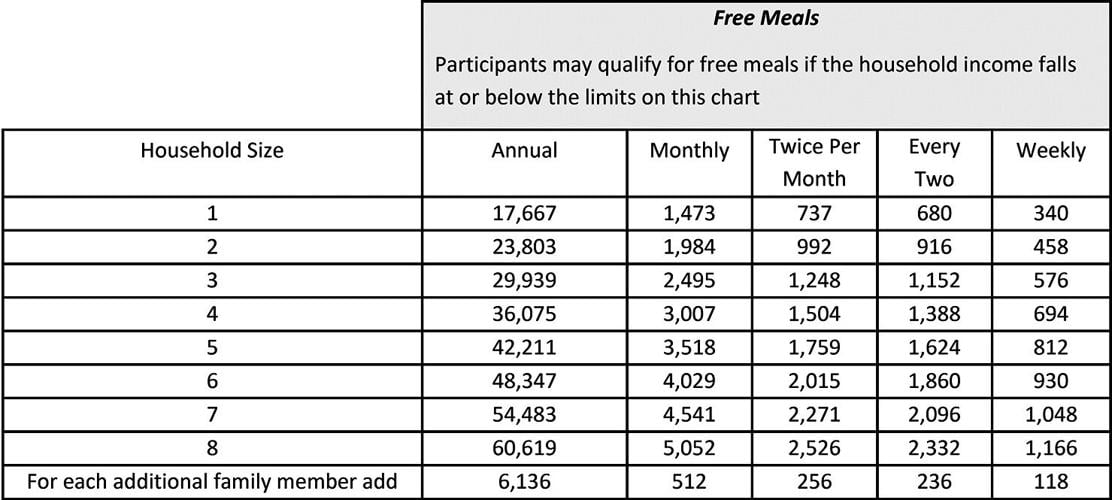

guidelines for 20222023 free and reduced price lunch, The average amount of eitc received nationwide was about $2,541 1. Income limits and amount of eitc for additional tax years.

IRS Form 15112 Fill Out, Sign Online and Download Fillable PDF, To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years. The limit is $22,320 in 2025.